Tips for Making More Sound Financial Projections in the New Year

|

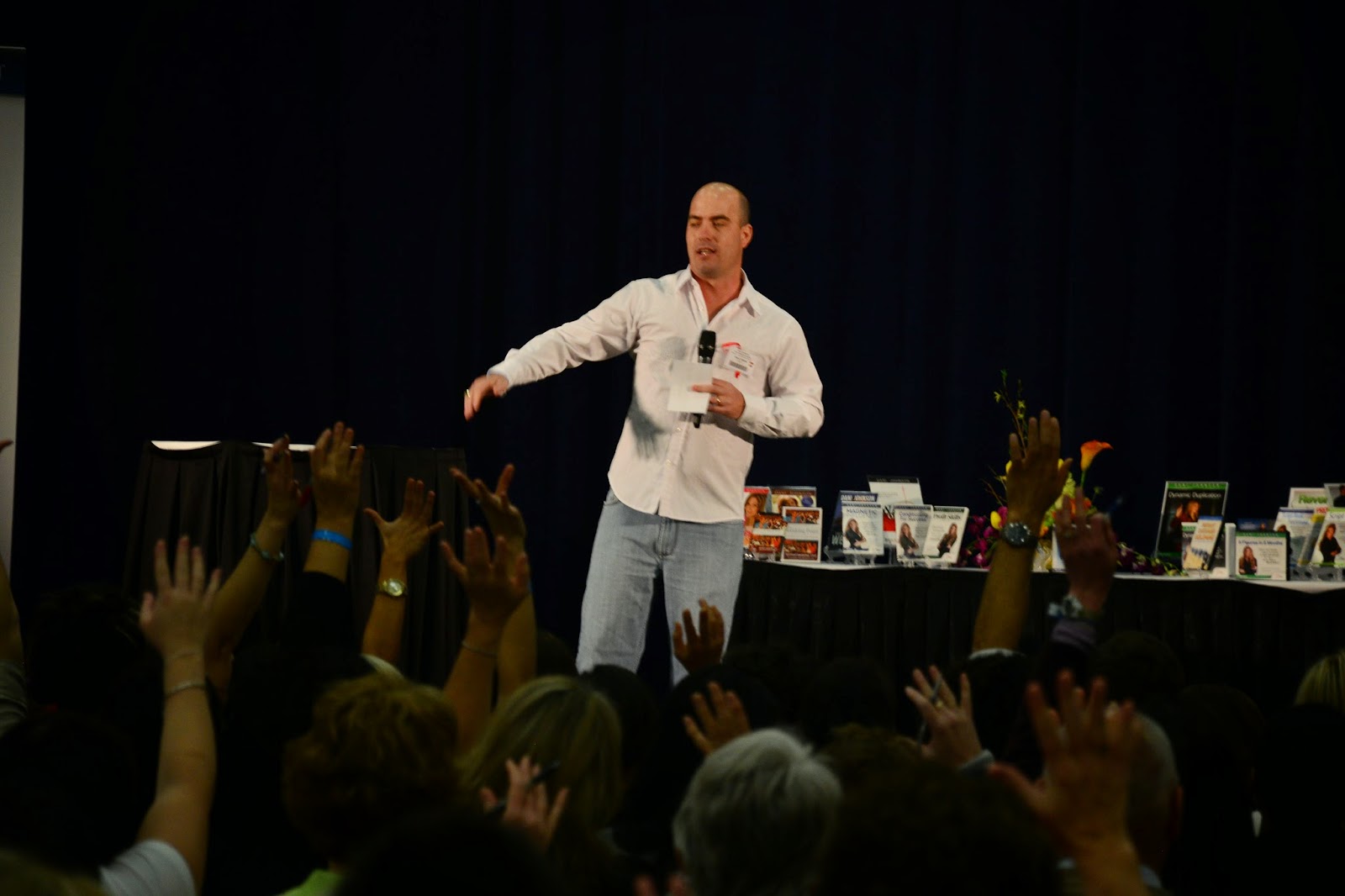

| Stacy explaining how Dani Johnson Training helped him earn 6 figures! |

One trait of entrepreneurs that can be both a blessing and a

curse is the sense of optimism. While every small business owner wants to believe

their ideas will be instantly successful, it is important to remember the

financials may be lean in the years leading up to a breakthrough. Overly

optimistic projections can often lead to making risky financial decisions,

which can often jeopardize the existence of a company. Here are some useful

tips to make realistic financial projections for the year ahead.

Know the Rhythm of Financial Cycles

For those who have been in business for a while, you

generally have a sense of the financial highs and lows of the company and if

that instinct is not inherent, past profit and loss statements can be studied

to discover different trends. These notions and reports are often a great

prediction for the future and can make projecting profits and losses for the

coming year a little easier. While every business wants to see growth, it is

also important to be realistic about when the business struggles throughout the

year.

Utilize Cash Flow Projections

Projecting cash flow is a great way to help plan for a

smooth financial year. By estimating how much cash the business will have at

the end of each month after paying overhead, employees, and the owner, it will

be easier to plan capital purchases or larger expenses that are not recurring.

This goes hand in hand with looking at the financial cycles of the business –

by knowing when money will be tight, it will be easier to plan larger expenses

and also focus on areas and times where revenue needs a boost.

Break-Even Points are Important

Any major spending decision should be based on the

business’s break-even point. This is a crucial part of small business financial

projections and is very easy to calculate – simply take your total fixed

expenses and divide by the gross margin per unit. The result of this calculation

is the number of units the business will need to sell in order to break even

throughout the course of the year. This number can then be divided by 12 in

order to see monthly sales goals to see if you can afford to make expensive

purchases.

Hope for the Best, But Plan for the Worst

As mentioned earlier, optimism can be a great asset for any

business owner, but can also be his or her biggest downfall. Every business

would love to see instant, huge financial success in its first few years, but

the reality is this is simply impossible for most to achieve. Although it may

be easier to predict a great financial year, it is better to be more reserved

with the projections and overshoot them rather than setting huge goals and

falling short, possibly doing irreversible damage to the business overall.

Revise, Revise, Revise

Once you think you have a solid financial projection for the

year, make sure to take the time to review it and revise anything that stands

out as unrealistic. In addition to revising the projection during the early

part of the financial year, make sure to continue to look at your projections

every month or so to make sure the business is on target to meet or exceed the

projections. This will help to give business owners a good indication of where

more focus needs to be placed or if the projections should be revised again.

Whether you have an existing work at home business that is

struggling or you are looking for an opportunity, Stacy O'Quinn can help you!

Stacy already has dozens of people that have made six figures a year thanks to

his help and you could be next! To learn more about Stacy, please click here.

No comments:

Post a Comment